Employee Misclassification

San Francisco Misclassification Attorney

Federal law regulates the way an employer must classify a worker, either as an employee or independent contractor. If you are an independent contractor and hire subcontractors you must also choose the proper classification. Our experienced lawyers can help you determine the proper classification and offer legal advice if an error has been made.

If a worker is classified as an employee, the employer normally must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages. These deductions would generally not be taken from an independent contractor.

Employment Classifications

There are four worker classifications, defined as follows:

- “Independent contractors” often have their own business or trade. The general rule is that one is an independent contractor if the person for whom the services are performed have the right to control or direct only the result of the work and not the means and methods of accomplishing the result.

- An “employee” is anyone who performs services for you, if you can control what will be done and how it will be done.

- “Statutory employees” are workers who would be independent contractors under the common law rules, but who may be treated as employees by statute for certain employment tax purposes.

- “Statutory nonemployees” are generally direct sellers and licensed real estate agents. They are usually treated as self-employed for all federal tax purposes, including income and employment taxes.

Determination of Worker Classification

To decide the classification of a worker, an employer must assess all the facts that reflect the level of control and independence of that worker.

Some key facts are:

- Does the company control or have the right to control how the worker does his or her job?

- Aree the business aspects of the worker’s job, such as how the worker is paid, controlled by the payer?

- Are there written contracts or employee-type benefits?

- Will the relationship continue?

- Is the work performed a key aspect of the business?

If an employer misclassifies a worker without reasonable cause, the employer may be liable for employment taxes, unless the employer had reasonable cause for not qualifying a worker as an employee. The employer must file proper returns on a basis consistent with how that employer actually treated the worker.

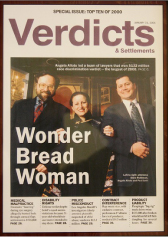

If you believe you have suffered from or taken action to misclassify a worker, an experienced law attorney can best investigate all the facts to determine if federal laws have been violated. Contact the Employment Attorneys at the Angela Alioto Law Group to schedule a consultation with one of our lawyers.